As we enter a new era of investing, one thing is clear: technology is reshaping how wealth is built. Transformational AI and blockchain are tackling the very issues that have kept 99% of investors from achieving the returns of the Rich 1%. Welcome to what we call the Wealth 3.0 Revolution.

A Quick History of Wealth Creation

The world of investing has evolved in waves, and understanding these changes helps explain why some people keep getting richer while others stay on the sidelines.

Wealth 1.0 [Paper] – Back in the 1980s, wealth was paper-based. Think share certificates, bonds, and traditional investments. Access was limited, and the system mostly catered to the wealthy.

Wealth 2.0 [Digital] – Starting in the late 1980s, digital technology transformed investing. Computers, the internet, mobile communications, and databases put superannuation, pensions, and other digital assets within reach of the masses. While this gave everyday investors more security, the Rich 1% still pulled away, getting dramatically richer.

Why the Rich Keep Getting Richer

Even when everyone can access the same markets, the Rich 1% consistently outperform the rest.

- Business owners build wealth faster than employees.

- Executives earn more than average employees.

- High net-worth individuals earn at least 50% higher returns annually than the mass affluent.

Here’s why that matters:

If the mass affluent earn 8% net on their portfolios and the Rich 1% earn 12%, that extra 4% compounds over time:

- After 20 years, their portfolios are double the size

- After 30 years, they are triple the size

For someone already wealthy, a few extra millions might not change much. But for the 99%, compounding like this can be life-changing.

Why the Rich Earn More

It boils down to two things:

-

Access to alternative assets – private equity, venture capital, infrastructure funds, commercial property syndications.

-

Professional financial advice – guidance that ensures they act confidently and effectively.

So why don’t the 99% just copy them?

- Only 22% of Australia’s wealthy invest in alternative assets because these opportunities are exclusive.

- Many mass affluent investors reject financial advice, seeing it as expensive, biased, or less relevant. This is known as the Advice Gap, a growing national issue.

Financial advisors provide two key things:

- Financial Strategy: Planning, allocation, and product selection

- Personal Expert Support: Confidence and guidance to act without mistakes

Enter Wealth 3.0

The Wealth 3.0 Revolution is technology-driven:

- Fractional Access to Alternative Assets: Blockchain allows previously exclusive investments to be split into smaller, tradeable units. By 2030, private equity, infrastructure, and more will be widely accessible.

- Affordable AI-Driven Advice: Robo-advisors powered by AI can provide personalised strategies at a fraction of current costs. By 2030, traditional advice models could become economically obsolete.

In short, the 99% finally have the opportunity to start creating wealth like the Rich 1%.

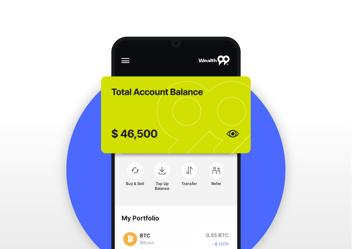

How Wealth99 is Supporting Investors

Wealth99 is at the forefront of the Wealth 3.0 Revolution. In the emerging Crypto-Wealth sector, we:

-

Make tokenized assets like crypto and precious metals accessible.

-

Provide expert guidance to help investors navigate these new opportunities with confidence.

Our focus is on helping Australians thoughtfully incorporate these tools into their overall financial strategies—clearly, practically, and without the noise or hype.

Lessons From History: Why Consistency Wins

Looking at past market cycles reveals some timeless principles:

- Avoid timing the market: Panic leads to missed opportunities.

- Invest consistently: Diversified portfolios beat cash over time, even with volatility.

- Focus on what you can control: Fees, taxes, and strategy matter more than short-term market movements.

By the numbers:

- Over 120 years, stocks returned 4–5% more than cash per year

- Bonds returned around 2% more

- Smart fee and tax management can save hundreds of thousands over a lifetime

Risk Reflection

The best portfolio is one you will stick with. Reassessing your risk tolerance as priorities change is key. Honest self-reflection combined with disciplined execution is more important than chasing short-term gains.

Markets are influenced by external factors like oil prices, OPEC+ decisions, geopolitical events, and global growth. Staying informed helps investors position themselves strategically, but the core principle remains: long-term planning and consistent execution.

The Takeaway

Wealth 3.0 is not just about technology. It’s about access, strategy, and guidance. Fractional alternative assets and AI-driven advice are bridging the gap between the Rich 1% and the rest.

Anyone who plans, invests wisely, and leverages these tools can participate in the wealth-building opportunities of the next decade.

As part of our service for investors, we offer personalised no-cost strategy sessions designed to help you:

- Define your goals within your overall wealth building plan

- Understand your risk profile

- Map out a crypto strategy that suits your investment goals and timeline

With the market starting to shift, now is the time to position yourself wisely. If you’d like to learn more, get in touch with us to book a complimentary strategy call.

.svg)

.svg)

.svg)