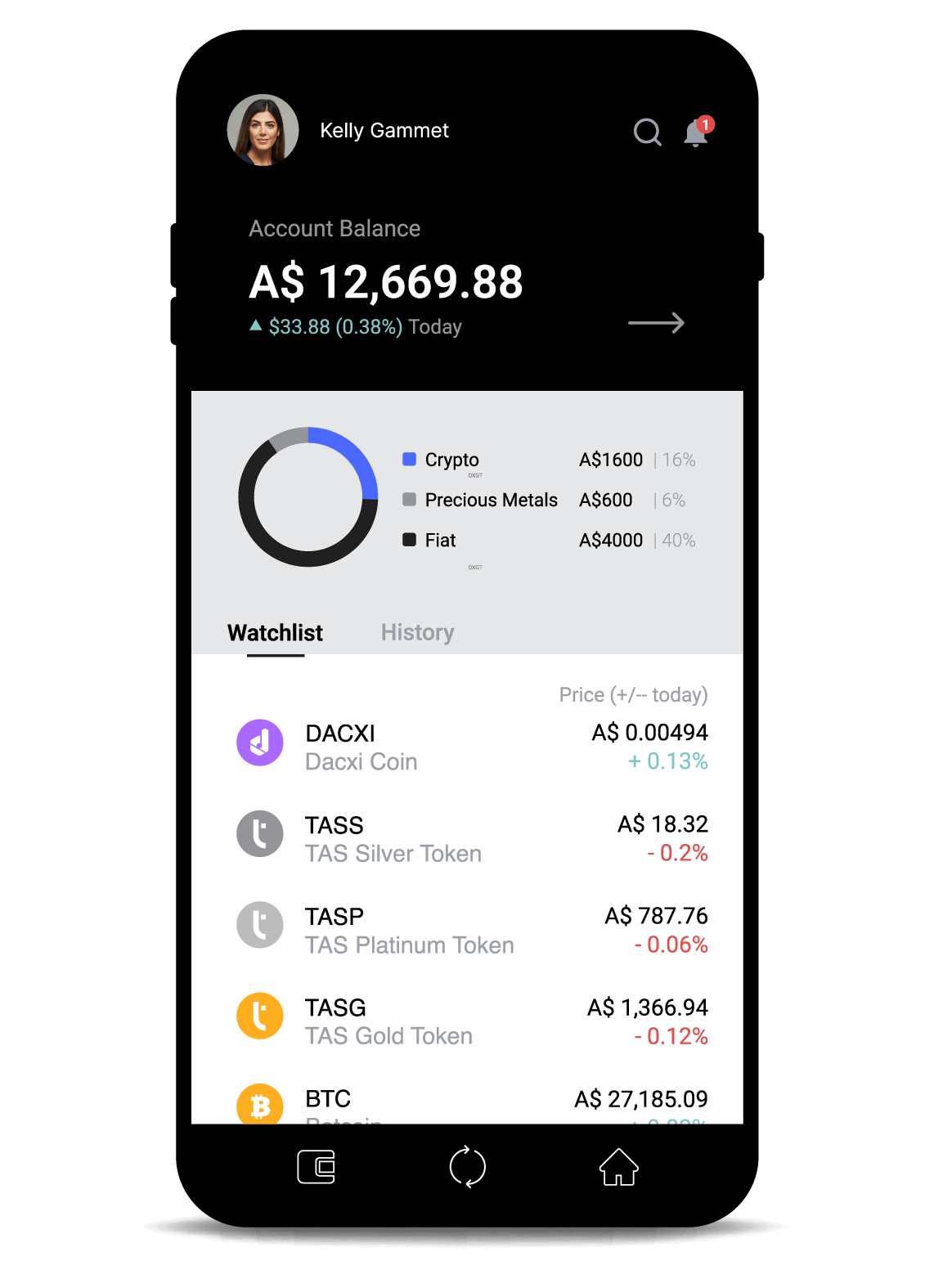

What are alternative assets?

Alternative assets are the new generation of investment opportunities – like crypto, digital assets, and tokenized assets. In a world where traditional assets aren’t performing like they used to, alternative assets can offer better returns, more diversified portfolios, greater tax benefits, and higher liquidity. Making them a vital part of any forward-thinking investor’s portfolio.

“40% of investors plan to shift hedge fund assets to alternative asset classes.”

EY.com

What is asset tokenization?

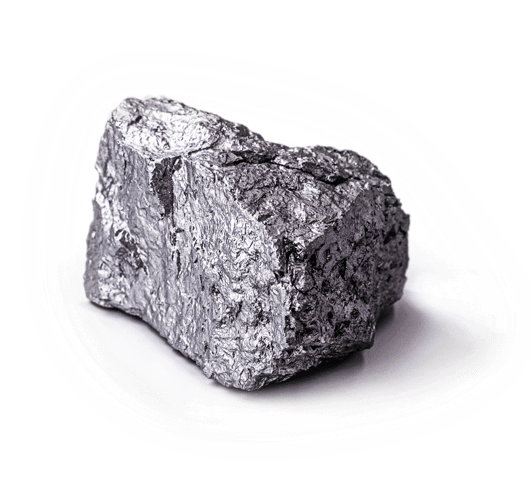

Asset tokenization is the process of creating digital versions of real-world assets. Powered by blockchain technology, tokenization allows for fractional ownership of assets. In doing so, it’s democratizing wealth for the 99%. And unlocking investment opportunities that were one reserved for the financial elite.

At Wealth99, we’re pioneers in the field of tokenization. We were among the first in the world to create tokenized precious metals. Removing the logistical barriers to purchasing physical metals, and giving everyday people the opportunity to quickly and easily invest in gold, silver, and platinum.

Alternative assets are the future of investing

The alternative asset market is expected to grow to $17trillion by 2025. There’s no doubt this new asset class is a compelling way for everyday people – the 99% – to take control of their financial future.

The only issue is figuring out how.

As with all things ‘new’, ‘emerging’, or ‘alternative’, awareness and education are critical. That’s what Wealth99 is here for. We provide everyday people and financial advisers with the support, resources, and knowledge needed to unlock the potential of alternative assets.

From ESGs to NFTs, crypto to tokenization. This new world brings new ideas – and new complexities – with it.

As the world’s leading New Wealth platform, Wealth99 is here to help solve them.

Building lasting crypto wealth:

The four essentials

Platform Built for Wealth

Curated investable assets designed for long-term growth—no speculative tokens, no distractions.

Institutional-Grade Security

For complete protection against theft or loss, your portfolio is held with insured, licensed custodians. This level of security meets SMSF requirements for securely held assets.

Expert Guidance

Personalised guidance from a dedicated crypto specialist will help you form your investment strategy and build unshakable confidence.

Support for Your Advisers

Tools and access that empower your financial professionals to save time, reduce risk, and optimise your wealth strategy.

The New Crypto Boom: What’s Driving This Cycle

Crypto is hitting new highs again. But if you’re expecting a repeat of past hype-driven cycles, you might be surprised. This...

The Wealth 3.0 Revolution: How Technology is Changing the Game for Investors

As we enter a new era of investing, one thing is clear: technology is reshaping how wealth is built. Transformational AI and...

Wealth99 Now Operating Under an Australian Financial Services Licence

Wealth99 Can Now Offer New Regulated Products Under an AFSL Quarterbar Financial Pty Ltd, trading as Wealth99, is proud to...

.svg)

-1.png)