If you’ve ever glanced at a news ticker, you know how it goes: “Markets down 1%,” “Stocks rally on good news,” “Global sell-off looms.”

Most of the time, they’re talking about indexes—those curated lists of companies like the S&P 500 in the U.S., the ASX 200 in Australia, or the FTSE 100 in the UK. Think of them as the economic world’s highlight reels: big companies, weighted by size, standing in for the health of entire economies.

But in crypto? Things aren’t so tidy.

There’s no universally recognised “crypto index.” Bitcoin still carries the flag for the entire industry—accounting for more than half the total market value. It’s the North Star. But beyond that, the waters are pretty uncharted.

What Traditional Investing Can Teach Crypto

The idea behind index investing is simple: instead of betting on one company, you bet on the entire market. It's the strategy Warren Buffett loves and John Bogle built a dynasty on.

Owning a little slice of a lot of companies tends to outperform trying to pick winners—and it does it with less stress, lower fees, and better sleep at night.

So: if index investing works in the stock market, could a similar idea work in crypto?

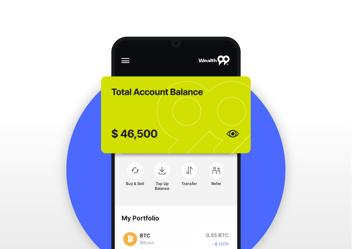

Enter Crypto Bundles

Unlike traditional equity indexes, crypto doesn’t yet have a widely-accepted, structured index system. But that’s where Bundles come in.

Bundles, like Wealth99’s Blue Chip or Blue Ocean offerings, aren’t indexes in the strictest sense. They’re curated collections of digital assets—tailored to investor profiles, market volatility, and long-term growth potential. They evolve, but not so frequently that they become confusing or unmanageable. Simplicity matters.

- The Blue Chip Bundle focuses on the most established, credible coins.

- The Blue Ocean Bundle takes a bolder approach—targeting high-potential, higher-volatility assets that aim for outsized returns.

And it works. Since inception over five years ago, the Blue Ocean Bundle has outperformed its Blue Chip counterpart by more than 50%. Greater risk, greater reward—just as traditional finance has long acknowledged.

-1.png?width=1500&height=750&name=Copy%20of%20Bar%20Chart%20-%20Email%20%26%20Blog%20(4)-1.png)

Over the past four years, the Blue Ocean Bundle has returned 244%—outpacing Bitcoin, the S&P 500, the Nasdaq, and the ASX 200 by as much as 1,500% along the way.

Growth, Super-Growth, and Hyper-Growth: A Framework for Crypto Investors

When you build a traditional portfolio, you might split it into stocks, bonds, and real estate—each with a different role. Crypto is different. It’s basically all growth. No dividends, no rental income, no bond yields. Just pure capital appreciation (or not).

Here’s one way to think about your crypto exposure:

-

Growth: Mostly the big, established coins; a small slice of emerging assets.

-

Super-Growth: A bigger tilt toward smaller, higher-potential assets.

-

Hyper-Growth: Mostly emerging coins, with just a foundation of the big players.

Even the boldest portfolios usually keep a little “anchor” in the established coins. Balance, even in a volatile space, still matters.

The Magic of Showing Up, Again and Again

One big mistake? Treating crypto like a scratch ticket: you buy once, you check it once, you forget it. The smarter approach is way less glamorous: invest steadily, over time, regardless of what the daily charts are shouting about. Regular contributions build wealth the way dripping water carves a canyon: slowly, quietly, but relentlessly.

In crypto, the people who’ve fared best weren’t the ones who bought the dip perfectly. They were the ones who simply stayed in.

Long-Term Thinking in a Short-Term World

Crypto moves fast. It’s tempting to jump ship at the first downturn—or double down at the first upswing.

But history (and traditional investing) tells us the real magic happens when you zoom out. When you stay invested. When you focus on building, not reacting. Because in the end, the biggest risk isn’t volatility. It’s getting spooked and selling too soon.

And as crypto continues to mature, thoughtful tools—like asset bundles—are helping bring a little more structure (and sanity) to a once-wild corner of finance.

For discerning investors, the crypto space is maturing. And as it does, tools like bundles are turning a once-speculative market into one that feels more strategic, accessible, and even—dare we say—sensible.

.svg)

.svg)

.svg)